Debt Consolidation Loan

What’s a Debt Consolidation Loan?

Debt consolidation loans consist of taking out one new loan to pay off multiple debts. Essentially, you are replacing multiple loans with one loan. Your home can be your biggest asset when trying to eliminate bad debt or consolidate your bills.

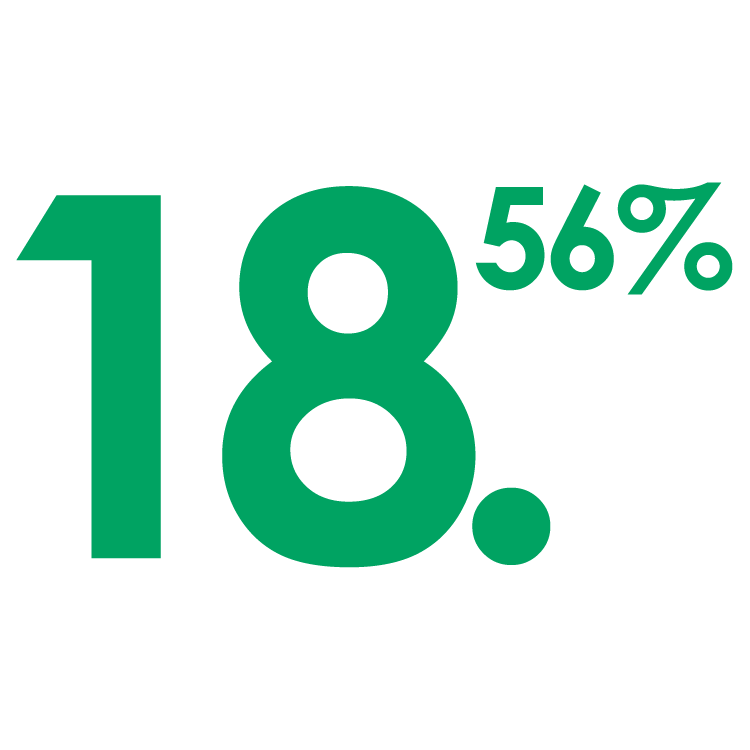

is the average annual percentage rate (APR) on a debt consolidation loan in the US. To put that into perspective, the average range of interest rates charged on debt consolidation loans typically ranges between 8.31% and 28.81%.

Mar 2018

For Qaulified Borrowers

|

|---|

Most Common Uses

|

|---|